|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Best Mortgage Refinance Calculator: A Comprehensive GuideRefinancing your mortgage can be a smart financial move, but understanding the potential benefits and costs requires the right tools. The best mortgage refinance calculator helps you evaluate whether refinancing is the right choice for you. This article will guide you through the key features of these calculators, how they work, and what to look for when selecting one. Understanding Mortgage Refinance CalculatorsMortgage refinance calculators are designed to estimate the savings and costs associated with refinancing your home loan. They factor in various elements like interest rates, loan terms, and closing costs. Key Features to Consider

Utilizing these features helps you make an informed decision, ensuring you find the most beneficial option. How to Use a Mortgage Refinance CalculatorUsing a refinance calculator is straightforward, but it requires accurate input data. Follow these steps:

For more insights, visit homebridge refinance rates to explore current offers. Benefits of Refinancing Your MortgageRefinancing can lower your interest rate, reduce monthly payments, and even shorten your loan term. However, it’s essential to consider both the immediate costs and long-term benefits. Lowering Interest RatesOne of the primary reasons to refinance is to secure a lower interest rate, which can save you thousands over the life of the loan. Changing Loan TermsRefinancing allows you to adjust your loan term, which can either lower monthly payments or help you pay off your mortgage faster. Understanding how long for refinance process can further aid in planning your finances effectively. Frequently Asked QuestionsWhat is a mortgage refinance calculator?A mortgage refinance calculator is a tool that helps you estimate the potential savings and costs of refinancing your mortgage, taking into account your current loan details and the terms of the new loan. How accurate are mortgage refinance calculators?While these calculators provide a good estimate, the accuracy depends on the data you input. It’s important to use precise figures for your current loan and the terms of the new loan. Can refinancing save me money?Yes, refinancing can save you money by reducing your interest rate, changing your loan term, or lowering monthly payments. However, it's crucial to weigh these benefits against the costs of refinancing. https://www.reddit.com/r/personalfinance/comments/r1fe1z/good_refinance_calculator/

I'm looking to refinance, but am struggling to find a calculator that can tell me exactly when I'd break even on the mortgage. https://www.dinkytown.net/java/mortgage-refinance-calculator.html

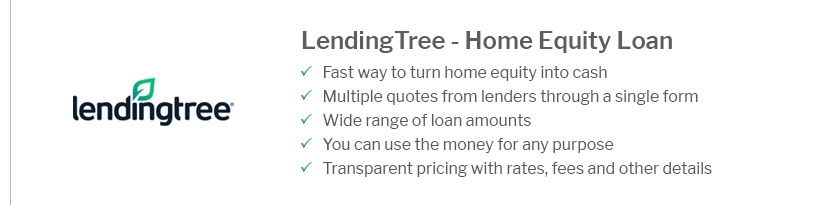

The mortgage refinance calculator helps sort through the confusion and determine if refinancing your mortgage is a sound financial decision. https://www.lendingtree.com/home/refinance/mortgage-refinance-calculator/

LendingTree's mortgage refinance calculator can help you decide if it's worth it to replace your current loan with a new one.

|

|---|